BUCKHEAD FINANCIAL EXPERTS WEIGH IN ON THE AGES AND STAGES OF FINANCIAL HEALTH.

Buckhead is the home of the young and fun, the rich and famous, and the career driven and family focused. It’s where major corporations see profits grow and retired CEOs come to downsize. One of the common threads that unites this eclectic community is the pursuit of a high quality of life—and money. According to the National Association of Realtors. Buckhead is home to the metro area’s top earners: The median household income is about $133,000. That income is 132 percent higher than the rest of metro Atlanta on average. (Realtor.com reports that Buckhead’s average household net worth is $967,000.)

Whether your annual earnings are moderate or millionaire level, the challenge is the same: How do you enjoy your money and make it last through retirement?

“People will spend more time trying to plan out spring break or summer vacation than they do planning for their future,” says John Inhouse, a market executive at Merrill Lynch in Buckhead. “The earlier you start planning, the better.”

To help you navigate your money matters, we talked to some of Buckhead’s top financial advisors about planning for the ages and stages of life.

Here’s their advice on how to make your loot last through your golden years.

NAVIGATING FINANCES IN YOUR 20s

NAVIGATING FINANCES IN YOUR 20s

When you are young and carefree, saving for retirement may be the last thing on your mind. Fresh out of college, your focus is on the immediate future. You want the perfect job, a nice car and a lifestyle with the trappings to complement your success. Sometimes, 20-somethings fail to see what lies ahead because they don’t plan enough for the future.

EXPERT ADVICE >

TED JENKIN

Financial mistakes made by 20-somethings:

“One of the biggest mistakes that Millennials and Gen Xers make is that they don’t budget properly,” Jenkin says. “They do their finances inverted. They spend most of their money, and they say at the end of the month, ‘If I can save any money from this check, I’m going to do it.’ You know what ends up happening— dining and entertainment in Atlanta takes their money, the clothing stores take it, the kids.”

Financial fixes:

“You have to pay yourself first,” Jenkin says. “Take [your savings] off the top, and then you won’t feel so guilty about what you spend on the bottom. The long-term goal is to save 20 percent of your monthly income. Start with 3 percent, then 5 percent, and then as you get bonuses and raises, save one-third of everything. If you do that, lifestyle inflation won’t creep in on you. If you get a $10,000 raise, and you expand your lifestyle, it’s really hard to contract it when the economy turns south.”

Make sure you have a family budget that works. “The more people do online bill pay, the less line of sight they have over their family finances,” Jenkin says. “People get into a term that I call ‘clickyitis’. If a bill pops up on online bill pay, and it says $500, as long as it’s in the field goal range, they will pay it. You have to keep track of your income and expenses. You have to plan for retirement. Invest in your company’s 401(k) plan, and get the matching funds. No financial advisor gives you a 100 percent return on your investment. “When it comes to investing, the rule that I tell people is to ‘act your age,’” Jenkin says.

According to Jenkin, if you start investing in your late 20s then under his rule, “30 percent of your money should be invested in bonds and 70 percent in stock.”

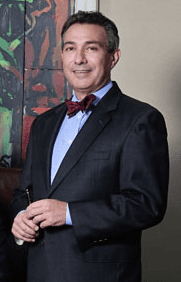

MARC DANER

Financial mistakes made by 20-somethings:

“They delay saving for retirement,” Daner says. “There is a very good likelihood that Social Security will be very different when people in their 20s reach retirement age. It will likely pay for a small percentage of their lifestyles, and they are going to have to focus on funding the rest.”

Financial fixes:

“Even if you put 1 percent of your pay in a 401(k), it’s better than nothing,” Daner adds. “Ninety-nine percent of people in their 20s should choose a Roth 401(k) over the traditional 401(k). A traditional 401(k) gives you a tax deduction when you put the money in, but when you take the money out, 100 percent of it is taxable income. With a Roth 401(k), you have more of a benefit. You don’t get the tax deduction when you put it in, but when you take the money out at retirement age, it is tax-free.”

Daner also recommends that Millennials buy disability insurance. “Someone in their 20s is significantly more likely to suffer a disability than to die. If they become disabled, they have a high probability that they will lose their income. Most companies provide short-term disability insurance. Typically, you would want a plan that would pay 60 percent of your income.”

NAVIGATING FINANCES IN YOUR 30s

When you reach your 30s, the responsibilities of life can take a firm grip on your finances. You have mounting debt—credit cards, car loans, student loans, maybe a first-time mortgage. Your career is demanding, and perhaps your new family is growing. Whether you are married or single with a career, or are still in graduate school, you can make financial missteps in your 30s if you don’t save for retirement.

EXPERT ADVICE >

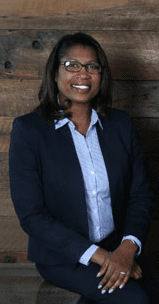

EMMA FOULKES

Financial mistakes made by 30-somethings:

“The biggest mistake is immediate gratification. They buy too much house, too much car. You can get yourself into a lot of trouble living like that, especially if you lose your job or if your spouse gets downsized. By your 30s, you should have six to eight months of living expenses in cash reserves tucked away in a savings account for emergencies,” Foulkes says.

Financial fixes:

“Get as close to maxing out your 401(k) as possible. Try not to use this as an emergency fund because you face penalties for taking money out before retirement. Look into a Roth IRA for the tax advantage. Put money into a brokerage account and begin investing in stocks and bonds. If you need seed money for real estate or a new business, you will have it.”

If you’re drowning in debt in your 30s, you can still develop a plan to stay afloat financially, Foulkes says. “You can pay down debt, save for emergencies, and save for retirement at the same time. Pay yourself first. If you have $100, put $20 toward savings, $20 toward retirement, and $60 toward your debt. You don’t want to miss out on the time value of money. If the market is down, and you are able to put money away for stocks and bonds, you are buying stuff on sale. You also have to put money in savings so that you will have cash reserves. If you just focus on paying down debt and you need new tires and brakes, you can get deeper in debt using credit cards to pay for emergencies. Life happens. If you have an emergency fund in cash reserves, you can pay yourself back at zero percent interest versus paying a credit card back at 12 percent. If you put yourself on a schedule to get out of debt, as you start paying your cards off, you can put even more money into retirement and savings. Find a certified financial planner to help you to develop a retirement investment strategy for your golden years.”

KASEY GARTNER

Financial mistakes made by 30-somethings:

“They don’t see the value of saving early and often to pay off debt, to buy a car, or home,” Gartner says. “It takes a long time to accumulate enough savings to make happen what you want to happen. Typically, you want to save 20 percent or sometimes 40 to 50 percent of your paycheck. I will work with families that, if they can swing it, will live off of one spouse’s paycheck and save the other.”

Financial fixes:

Gartner likes the Roth 401(k) and advises people in their 30s to develop an aggressive investment portfolio (you can save $18,000 per year). “Stocks are going to be a lot riskier than bonds are going to be,” she says. “I talk to my clients about their comfort level. Personally, I’m 34 years old, and my retirement investment portfolio is 100 percent stocks. I have other portfolios that are not. I don’t plan on using that portfolio for 30 years. As my retirement gets closer, I will start folding in some bonds.”

Life insurance can also be a strategic investment Gartner says. “Permanent insurance, if structured appropriately with the right insurance carrier, has meaningful value that is accessible to you on a tax-preferred basis while you are still living. I have a colleague who used the policy his parents took out on him as a child. He paid for his wedding 30 years later. It didn’t make sense for him to cash out his stock portfolio to pay for his wedding. Be sure to work closely with your advisor when using life insurance cash value. Loans taken against a life insurance policy can have adverse effects if not managed properly. Policy loans and automatic premium loans, including any accrued interest, must be repaid in cash or from policy values upon surrender, lapse or the death of the insured. Repayment of loans from policy values upon surrender or lapse can trigger a potentially significant tax liability, and there may be little or no cash value remaining in the policy to pay the tax. The policy will lapse if loans become equal to the cash value while the policy is in force, and additional cash payments are not made.”

NAVIGATING FINANCES IN YOUR 40s

There is a fiscal reason why your 40th birthday can be difficult to face. At this stage, the choices of your youth have a direct impact on your quality of life. Retirement stares you in the face like a nosey neighbor. Aging parents and teenage children may begin to drain your resources. You question your longevity, your career choices and whether you are on track to reach your financial goals and retire with a sense of security.

EXPERT ADVICE >

MARC DANER

Financial mistakes made by 40-somethings:

“People in their 40s tend to spend too much money on their kids. That can include buying them a car, putting them in private school and paying for college.”

Financial fixes:

Focus on your retirement, Daner adds. “If you are on track for retirement, that is when you put money into 529 Education Savings Plans. They are good tax shelters. The one caution is if the money is not used for education, you pay taxes and a penalty when you take the money out. You also can open up an Education Savings Account. It works similarly to a 529. It is capped at $2,000 per year. The money can be used for any level of school—for private school, a tutor and school supplies at any age.”

TED JENKIN

Financial mistakes made by 40-somethings:

“They don’t think about how much insurance they will need,” Jenkin says. “Your 40s is the time to think about whether you have enough life insurance. One of the biggest costs that people don’t see on the horizon is having a need for skilled nursing care. Who’s going to take care of Mom and Dad? Paying for skilled nursing for a parent can be a stress on the family finances for Gen Xers who are in the middle of raising their kids.”

Financial fixes:

Buy more insurance and focus on your retirement savings, Jenkin says. “Look at your Social Security and your pension. You are going to need to replace 60 to 70 percent of your income today. If you make $100,000, your investments, your Social Security and your pension will need to generate $60,000 to $70,000 a year.’’

If you’re considering an annuity to guarantee retirement income, make sure you are up for the gamble, says Jenkin. “A great analogy to explain annuities is like playing a big hand of blackjack. If you had $250,000 on a hand, and the dealer turned 21, they would ask you, ‘Do you want to buy insurance?’ In an annuity, you pay an insurance company to buy insurance on your investment. If you want the guarantee that you are going to get income when you retire, it’s a great idea. If you don’t need a guarantee, I wouldn’t buy an annuity.”

Also, consider downsizing as you approach your 50s. “So many people have refinanced and refinanced that it makes it difficult to step away from their job if they still have a mortgage. The best thing to do once the kids get out is downsize. It lets your kids know that [home] is not a place that they can move back to and stay.”

NAVIGATING FINANCES IN YOUR 50s & 60s

As you approach your golden years, retirement is within reach, but you still may have some anxiety about a future without full-time employment. You spend your 50s and early 60s reaching the top of your earning potential. Then you have to decide whether to keep on working and delay retirement or exit gracefully to travel, volunteer and spend time with grandkids. You still crave a challenge and want to give to charity. (Baby boomers give more to charity than any other generation. The Buckhead average contribution is $1,400 per retiree, higher than any other group, according to a Merrill Lynch study on giving in retirement.)

EXPERT ADVICE >

EMMA FOULKES

Financial mistakes made by 50- and 60-somethings:

“They continue to rescue their adult children. If you’ve got adult children that have graduated from college, you’ve got to cut them off at some point. If not, when you retire, they are still going to come to you for money.’’

Financial fixes:

“Once you reach 62, explore your Social Security benefits. If you are divorced and had been married for 10 years, you can possibly receive half of your ex-spouses benefits, if half of your ex-spouse’s benefits will be more than yours. I always suggest that people get with a certified financial planner to get an assessment of where they are financially and get a comprehensive financial plan. Have your financial advisor run an analysis on your using a program called a Monty Carlo Simulation. It runs through hundreds of different market conditions from the Great Depression to 9/11 to see what your probability is to survive if everything was horrible a year from now until you live out the rest of your life. Even if you have $1 million saved, that isn’t a lot of money anymore. The rule of thumb is to peel 4 percent away annually for living expenses. That’s $40,000. If that isn’t enough for you to live off every year, then you will need $2 million saved to have at least $80,000 to live off of annually.”

You can continue to save and delay taking Social Security until age 66 or 70, Foulkes adds. “Every year that you delay beyond your normal retirement age, your benefit grows by 8 percent until age 70.”

JOHN INHOUSE

Financial mistakes made by 50- and 60-somethings:

“We do run into a lot of clients that have way too much life insurance,” Inhouse says. “A lot of them forget that they have life insurance policies. There is less of a need for life insurance when your kids are grown. “

Financial fixes:

“Make sure that you have adequate long-term care insurance,” he says. “If you have to spend $15,000 to $20,000 a month on unexpected health care costs, that could devastate your portfolio.”

Co-founder and principal senior

managing partner at Atlanta Capital

Group

jshaver@atlantacapitalgroup.com

JEFF SHAVER

Financial mistakes made by 50- and 60-somethings:

Some people approaching retirement age make Social Security their retirement strategy because they don’t have a financial plan, or they never fully recovered from the loss of income they suffered during the recession, Shaver says.

Financial fixes:

“You have to make time your friend,” Shaver adds. “If you have the opportunity, work until a later day, thereby increasing the number of years you are saving and reducing the number of years that you will be a net spender.”

DAVID CROOK

More financial fixes:

“Gone are the days when you could expect to live on a fixed income on bonds. In terms of designing your portfolio, you need to be considerate of the fact that you want to protect against the downside. If you lose half of your wealth in your 20s, you have years to make it back. If you are 55 to 65 years old, you have a lot less time to make it back. “Basic math will tell you that if you have a $100,000 portfolio and you lose 20 percent, that goes down to $80,000. Just to get back to your break-even point, you will need to increase the portfolio by 25 percent. At the moment, we would recommend an over-allocation to stocks in relation to bonds. We would be allocated across different stocks and bonds to reduce the risk and the volatility in a portfolio. There is no standard allocation across asset classes. People need to be diversified in their senior years. We do a plan for each of our clients that we do not charge for. It allows us to determine their asset allocation given their goals.”

STORY: D. Aileen Dodd PHOTOS: Sara Hanna

Simply Buckhead is an upscale lifestyle magazine focused on the best and brightest individuals, businesses and events in Buckhead, Brookhaven, Sandy Springs, Dunwoody and Chamblee. With a commitment to journalistic excellence, the magazine serves as the authority on who to know, what to do and where to go in the community, and its surroundings.

NAVIGATING FINANCES IN YOUR 20s

NAVIGATING FINANCES IN YOUR 20s