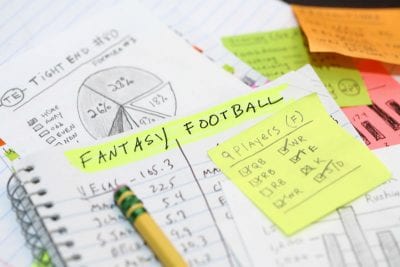

The football season is upon us again here as the fall rolls around and neighborhoods and workplaces are buzzing with Fantasy Football fever. The Fantasy Trade Sports Association commented that the Fantasy Football market is more than a 70 billion dollar industry today and growing. With so many people joining multiple leagues, what can this popular game teach us about how we manage our portfolios and diversify our assets.

Do Your Homework?

It’s shocking how many people don’t know what they own in their 401(k), IRA, or their brokerage accounts. You may have purchased a target fund or some growth and income fund, but you don’t actually know what you own. Moreover, you may not understand the risks on how much you could gain in one year or how much you could potentially lose in one year. It’s important to read the prospectus before you invest, look at the track record of the investment you will be making, and learn more about who will be managing your money. Don’t just pick an investment because you heard it is a good one for your money.

Don’t Bet On One Player?

With all of the hoopla around the FAANG stocks and the transformation of blue chip central moving from the east coast to the west coast, be very very careful about picking just one company for all of your assets. It can be incredibly tempting to tell yourself that some of these technology companies have ‘no way of losing’, but be mindful that the tables can turn quickly if a company gets injured just like a player can on the field. Remember, in the smartphone space companies such as Motorola, Nokia, and Blackberry were thought of as companies that you could never lose money on and look at how they have done the past ten years.

Do You Need Insurance?

In Fantasy Football, there are actually several companies who offer Fantasy Football Insurance. Insurers can pick one of three policies the policy price will vary depending on how many players you choose to insure). For example, you can insure your most important star player against missing nine games in the event of an injury. If the fantasy football pool is $200, it will cost you around $20 to ensure that one player. With your overall investment portfolio, you might consider using an insurance company to help you mitigate some risk or use stop losses to limit your downside risk. Either way, you may need to consider how to protect your nest egg with the markets hovering at all-time highs.

Monitor and Track Performance

It’s important that at least once per quarter you sit down either with a professional or on your own and track the performance of all your investments. Just like Fantasy Football, some star players may take a turn for the South or some players will come off the bench and end up being a diamond in the rough. The worst thing you can do is to just sit on the sidelines and assume that your players will perform. Remember, coaches and players also change teams. Just because a mutual fund has a good track record doesn’t mean it will necessarily do better in the future if the fund manager who ran that fund switched teams to go to another company.

Simply Buckhead is an upscale lifestyle magazine focused on the best and brightest individuals, businesses and events in Buckhead, Brookhaven, Sandy Springs, Dunwoody and Chamblee. With a commitment to journalistic excellence, the magazine serves as the authority on who to know, what to do and where to go in the community, and its surroundings.